“Just rub some dirt on it.” It’s something many of us heard as kids, usually from grizzled adults teaching us to deal with minor aches and pains. It’s right up there with hearing about walking five miles to school in the snow — uphill, both ways — in the ‘toughen up, kid’ hall of fame.

With age and wisdom, you hopefully graduated to more sensible treatments — rest, ice, compression, elevation or maybe an over-the-counter anti-inflammatory. In addition, if you still feel the need to rub something on it, anti-inflammatory topical creams are a slightly more effective, and more sterile option than dirt.

When it comes to price, these topicals may not be as cheap as dirt, but they should be close. Unfortunately, many nontraditional pharmacies and dispensing physicians are trying to convince workers’ compensation payers that topicals with ingredients identical to less expensive brand-name medications should cost $1,000 or more. That’s some pretty expensive dirt.

Out-of-network pharmacy spending on topicals is out of control

This article could also be called “The Paper Tsunami” or “The Great Paper Chase” to describe the market conditions present in workers’ compensation pharmacy management. That’s because payers in our system are seeing drastic increases in out-of-network pharmacy billing and corresponding spend. On analysis, MyMatrixx by Evernorth has found that a disproportionate amount of this is due to a rise in physician dispensing and use of nontraditional pharmacies.

At MyMatrixx, we’ve taken a closer look to help better manage costs for clients. As we dug deeper, we discovered a trend where the cost of one category of generic medication was driving the majority of spend. Specifically, topical medication was being dispensed through these channels at significantly marked-up rates while often using the exact same ingredients as widely available products.

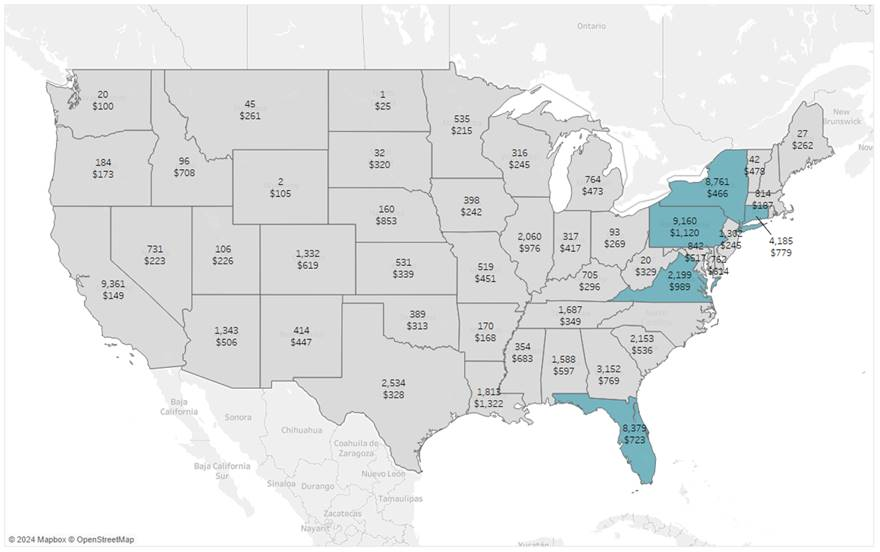

For a deeper look at topical utilization and spend, check out our recent article and infographic. As shown in the map below, much of this spending is concentrated in certain geographical areas and limited to a short list of products:

Chart Key

Topical prescriptions represent 27% of the total utilization; however, they are responsible for 60% of the script cost. Five states driving topical cost based on utilization and spend:

- In NY, utilization of topicals is 12% of the total scripts filled and 25% of cost

- In FL, utilization of topicals is 1.2% of the total scripts filled and nearly 30% of the cost

The medications driving the cost of topicals are:

- Diclofenac 1.5% solution

- Diclofenac 3% gel

- Methyl salicylate-lidocaine-menthol patches

- Lidocaine 5% ointment

- Lidocaine patches (both 4% and 5%)

It may be surprising that an OTC product (lidocaine 4% patches) could be driving costs; however, there are just two lidocaine 4% products (NDCs) that are responsible for 85% of the costs.

This phenomenon is driven in large part by nuances and loopholes in certain state regulations. Out-of-control topical spending is most prevalent in states where legislation does not address nuances in the FDA’s National Drug Code (NDC) and average wholesale price (AWP) schedules. These conditions give so-called “gray actors” an opportunity for outlier pricing and profit.

In contrast, states with tighter controls on physician dispensing and topical utilization, spend is more in line with few exceptions.

A multi-pronged, collaborative approach to managing pharmacy spend

MyMatrixx has developed a multi-pronged toolset based on data analysis and clinical intervention to combat these practices, and we work closely with our clients to monitor and mitigate their pharmacy spend. However, the best opportunity for topical intervention is to work directly with regulators and legislators to examine market dynamics and change legislation to ensure an equitable balance for all stakeholders including providers, pharmacies, employers and insurers.

MyMatrixx is deeply invested in achieving meaningful change that benefits our clients and the injured workers we mutually serve. As part of Evernorth, the largest PBM in the country, we are on the front lines of this critical issue. We continue to be proactive and participate in most current, proposed and missing legislation in states including Florida, New York, Pennsylvania, California and Montana.

We are committed to a strategy of ongoing regulatory advocacy combined with a proprietary topical intervention toolset to continue mitigating cost outliers for our clients.